real estate tax shelter example

We also have a page about common issues with your tax bill. This is mainly due to its generous tax benefits.

Analyzing Investment Real Estate Cody A Ray

Ad State-specific Legal Forms Form Packages for Investing Services.

. A tax shelter is among other things any investment that has a tax shelter ratio exceeding 2 to 1. For previous years call the Collectors office at 617-635-4131. In 2022 employees can make up to 20500 in deductible contributions to a 401 k with workers age 50 and older entitled to deduct an additional 6500 in catch-up contributions.

Set Up a Retirement Account. These examples of tax shelters apply to real estate but there are others including tax-deferred retirement accounts 401ks and tax-sheltered annuities 403b. Monday through Friday 9 am.

So the investor has 5000 spendable cash in his or her pocket. 233 Procedural Filing Requirements. May 14 2022 minecraft mini figures series 25 codes 00420.

Massachusetts Property and Excise Taxes. This includes real estate leased to individuals and non-charitable entities including governmental entities or occupied or used for non-charitable purposes. You can get a municipal lien certificate to find out how much tax you owe on a property.

Real estate tax shelter example. As an example lets assume that a property has a cash flow of 5000 in other words the cash income from the property exceeds cash expenditures by 5000 for the year. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown.

Three Common Tax Shelters in Real Estate. A 401k or other type of tax-deferred retirement account like an IRA allows you to save money on taxes now. The tax shelter ratio is the aggregate amount of deductions to the amount invested.

RETs can include exemptions for certain types of buyers based on buying status or income level. A tax shelter is a method used by businesses and individuals to reduce their tax liabilities. A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year allocable to limited partners or limited entrepreneurs.

As knowledgeable replacement property professionals they help clients build a customized strategy that identifies suitable investments pursuing successful completion of a 1031 Tax-Deferred. There are material risks associated with investing in DST properties and real estate. Historically real estate has proved to be a significant tax shelter.

The Tax Court has consistently disallowed losses deductions and credits from transactions it deems to be tax shelters. WHAT IS A REAL ESTATE TAX. In this article well take a look at how investors can calculate a baseline tax shelter on their real property assets.

1 City Hall Square. Real estate tax shelter example. Real estate offers tax sheltering through depreciation operating expenses long-term capital gains and 1031 exchanges.

Here are nine of the best tax shelters you can use to reduce your tax burden. Tax shelters work by reducing your taxable income thereby reducing your taxes. Italian imperialism in ethiopia.

When the City makes a public improvement property owners in the area may be assessed a special property tax. The most common tax shelter is through such retirement accounts as a 401 k 401 b Roth IRA or a Roth 401 k. As knowledgeable replacement property professionals they help clients build a customized strategy that identifies suitable investments pursuing successful completion of a 1031 Tax-Deferred Exchange.

Tax shelters can range from investments or. To shelter real estate investment cash flow from taxes emphasize to investors that they can buy like-kind properties through tax-free exchanges also referred to as a Section 1031 exchange. The numbers listed below are annual.

There are many ways to reduce your tax burden but make sure you arent illegally evading taxes by using a legal tax shelter. A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more.

Browse discover thousands of brands. Ee the current RET rates across the country. In this case an investor can buy a second property without paying tax on the sale of the first property.

We created a separate guide for filing your personal property taxes. To see how a real estate tax shelter works lets go through an example using a 250000 property that generates 2000mo in revenue. To get tax information for the current fiscal year call the Taxpayer Referral and Assistance Center at 617-635-4287.

Streamlined Document Workflows for Any Industry. Also known as a real estate transfer tax a real estate tax RET is a tax on passing the home title from one person to anotherSt ates counties or municipalities can impose RETs. Law Procedures and Valuation Property Tax Exemptions 7 - 5 Generally all other real estate is taxable.

A limited entrepreneur is considered any business owner who is not actively engaged in the operations or. Other tax shelters include mutual funds municipal bonds. Find Forms for Your Industry in Minutes.

Read customer reviews find best sellers.

Top Tax Deductions For Second Home Owners

Commercial Real Estate Tax Benefits And How To Take Advantage Of Them Pioneer Realty Capital

Str 02 The Details On Using Short Term Rentals Losses To Reduce Active Income Technical Details

Income From Cloud Hosting And Its Ancillary Services Neither Royalty Nor Fts Itat Income Hosting Profitable Business

6 Tips For Building Generational Wealth Through Real Estate

Analyzing Investment Real Estate Cody A Ray

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

What Is The Biggest Tax Shelter For Most Taxpayers

What Is The Biggest Tax Shelter For Most Taxpayers

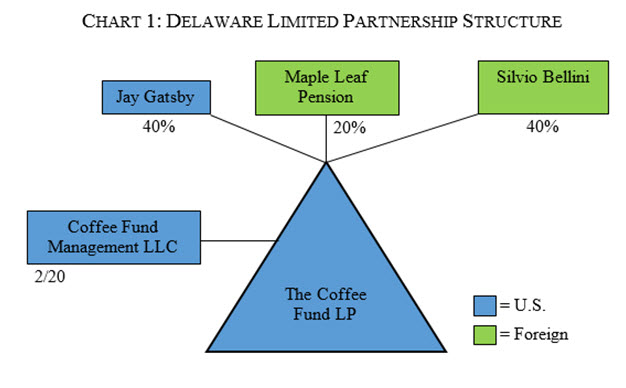

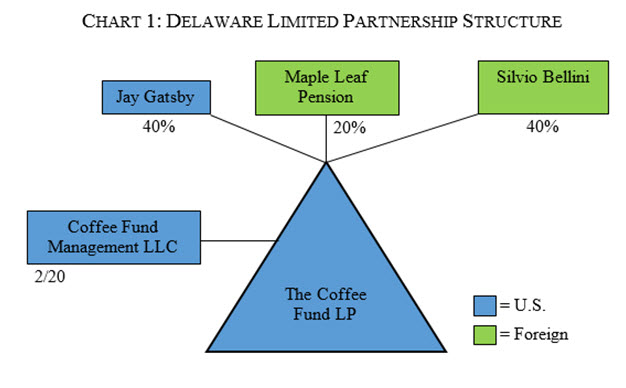

Structuring A U S Real Estate Fund A How To Guide For Emerging Managers Insights Venable Llp

How To Decide If A Property Is A Good Investment The Washington Post

Sample Printable Assignment Joint Ownership With Right Of Survivorship Form Real Estate Forms Legal Forms Free Lettering

Wholesaling Real Estate Taxes Ultimate Guide Real Estate Skills

Fresh Cell Phone Reimbursement Policy Template

Income Tax Calculation For Professional Cricketer 1 5 Cr Husband And Wife Income Tax Budgeting Income

Diy Or Hiring A Property Manager Which Is Better Property Management Real Estate Quotes Management

Tax Shelters Definition Types Examples Of Tax Shelter