texas estate tax exemption

Therefore there is no estate limit exemption or tax rates to be concerned about. In a Nutshell Property taxes can be high in Texas.

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Texas property tax exemptions.

. Over 65 Exemption. But dont forget about federal estate taxes. Senior Property Tax Exemptions in Texas.

Reining in taxes in the Lone Star State. Only one of you needs to be over 65 to qualify for the over age 65 homestead exemption. See Davies 541 SW2d at 828-830.

One strategy that can help you lower your taxes is applying for property tax exemptions and the veterans exemption is one of them. 1 day agoSchool districts must offer a 40000 exemption and other entities may exempt up to 20 of a homes value. Eligible seniors will get a 10000 exemption for school district property taxes.

For instance a home appraised at 700000 had to pay Frisco ISD 887040 in taxes. 2 Your home must be located in Texas. Therefore you and your wife will be able to file the required form in.

For persons age 65 or older or disabled Tax Code Section 1113 c requires school districts to provide an additional 10000 residence homestead exemption. Seniors older than 65 or disabled residents. The rates will start around 40 but there is recent discussions about increasing that rate and also decreasing the exemption.

And 2 homestead exemption for taxes other than school taxes. The exclusion is said to be unified because certain gifts transferred during a persons life will count against the total amount of transfers that can be made tax-free upon. It exempts at least 25000 of a propertys value from taxation.

Age 65 or older and disabled exemptions. 1 homestead exemption for school taxes. The most common is the homestead exemption which is available to homeowners in their primary residence.

However they do have the option of applying for a tax ceiling exemption which will freeze the amount of property taxes paid to the school district. Reduction to the Estate Tax Exemption. Totally blind in one.

To qualify for property tax exemptions for senior citizens in Texas the owner must meet the age requirements and live in the house. This article will help you understand Texas property tax exemptions for veterans help you apply for them and shed some light on other ways you can lower property. Texas Property Tax Exemptions Homestead Exemption.

Homeowners 65 years of age or older or those who are disabled can qualify for. The primary residence of the applicant. There are two kinds of homestead exemptions available to qualifying homeowners.

For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. The lifetime estate and gift tax exemptionalso known as the unified tax creditallows people to make tax-free transfers up to a certain amount during their life and upon their death. Tax Code Section 1113 d allows any taxing unit the option to decide locally to offer a separate residence homestead exemption of an amount which cant be less than 3000.

E A political subdivision choosing to tax property otherwise made exempt by this section pursuant to Article VIII Section 1e of the Texas Constitution may not do so until the governing body of the political subdivision has held a public hearing on the matter after having given notice of the hearing at the times and in the manner required by this subsection and has found that. The case of City of Austin v. As shown in the example above the residential homestead exemption allows you to reduce your tax.

12000 from the propertys value. Woman sitting at kitchen table seeing if she qualifies for any texas property tax exemptions. However this past year there were proposals seeking to reduce the amount to 35 million per individual.

This freeze amount is based on the year the individual qualified for the 65 or older exemption and can. The good news is that Texas does not have an estate tax. Before applying for either you must first meet the following criteria.

You may apply to your local appraisal district for up to one year after the date you become age 65 or up to one year after the taxes are due. An average homeowner in Texas pays around 3390 in property taxes a year. Exemptions for Seniors and the Disabled.

Tax Code Section 1113 d allows any taxing unit to adopt a local option residence homestead exemption. The amount of the estate tax exemption for 2022. The court of appeals opinion in University Christian Church v.

In Texas a property owner over the age of 65 cant freeze all property taxes. This local option exemption cannot be less than 3000. Over 65 Disabled Persons Exemption Texas Property Tax Code allows for an additional exemption for taxpayers 65 older or disabled persons Only applies to the taxpayers homestead not other properties owned City currently offers 20000 exemption in both Over 65 and Disabled Persons.

There are a number of exemptions that help lower your property taxes in Texas. Individuals age 65 or older or disabled residence homestead owners qualify for a 10000 residence homestead exemption for school district taxes in addition to the 40000 exemption for all homeowners. The exemption will be added to the existing 25000 homestead exemption.

But property tax exemptions can help lower tax bills for qualifying homeowners by removing. This means that when someone dies and. 1 You must ownoccupy your home.

If the owner qualifies for both the 10000 exemption for age 65 or older homeowners and the 10000 exemption for disabled. Texas estate tax. 1988 regarded a religious organization property tax exemption sought for parking spaces owned by the church.

The 2018 estate tax examption increase is only temporary so the base exemption amount is set to drop back down to 5 million adjusted for. University Christian Church 768 SW2d 718 719 Tex. The Texas Supreme Court affirmed.

The current amount is 1206 million. A disabled veteran may also qualify for an exemption of 12000 of the assessed value of the property if the veteran is age 65 or older with a disability rating of at least 10 percent. In the past year there were proposals to reduce the estate tax exemptionmeaning lowering the amount after which individuals will need to pay a tax on their estate.

In addition to the 25000 exemption that all homestead owners receive those age 65 or older qualify for a 10000 homestead exemption for school taxes.

Is There An Inheritance Tax In Texas

Over 65 Property Tax Exemption In Texas

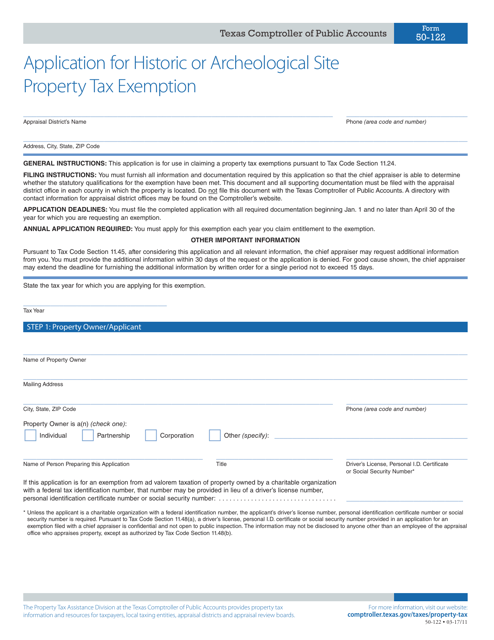

Form 50 122 Download Fillable Pdf Or Fill Online Application For Historic Or Archeological Site Property Tax Exemption Texas Templateroller

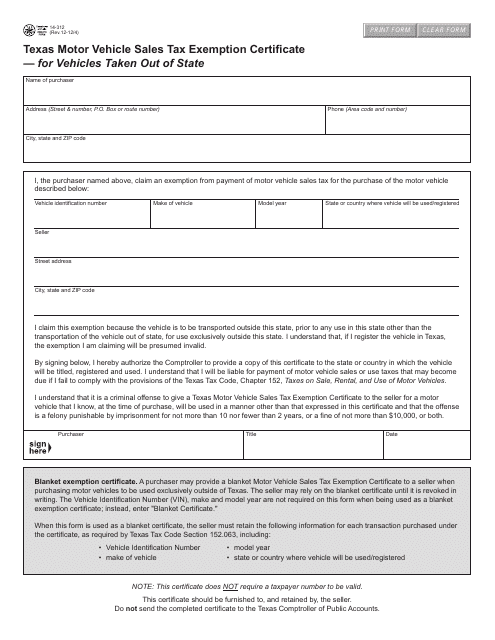

Form 14 312 Download Fillable Pdf Or Fill Online Texas Motor Vehicle Sales Tax Exemption Certificate For Vehicles Taken Out Of State Texas Templateroller

Tx Comptroller 01 924 2017 2022 Fill Out Tax Template Online Us Legal Forms

Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Texas Homestead Tax Exemption Cedar Park Texas Living

Texas Inheritance And Estate Taxes Ibekwe Law

Title Tip Another Legislative Update For Texas Homeowners Candysdirt Com

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

Texas Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Tx Comptroller 01 315 1991 2022 Fill Out Tax Template Online Us Legal Forms

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Qualifying Trusts For Property Tax Homestead Exemption Sprouse Shrader Smith

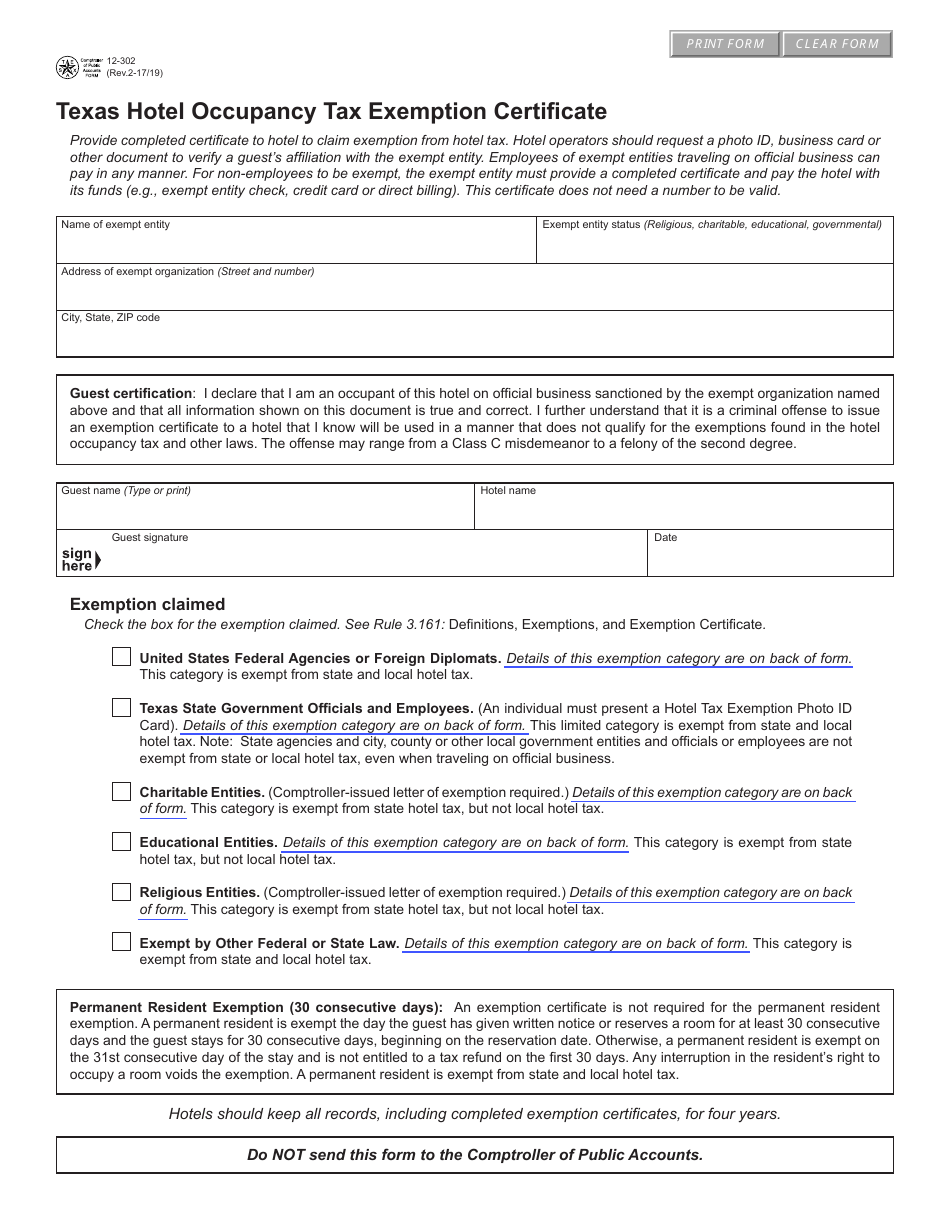

Form 12 302 Download Fillable Pdf Or Fill Online Hotel Occupancy Tax Exemption Certificate Texas Templateroller

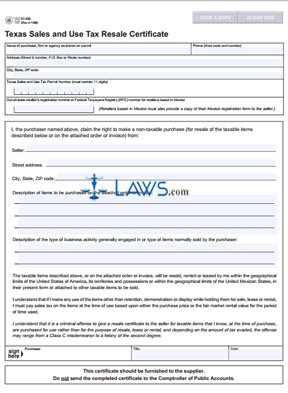

Free Form 01 339 Texas Sales And Use Tax Exemption Certification Free Legal Forms Laws Com

Texas Tax Exempt Certificate Fill And Sign Printable Template Online Us Legal Forms